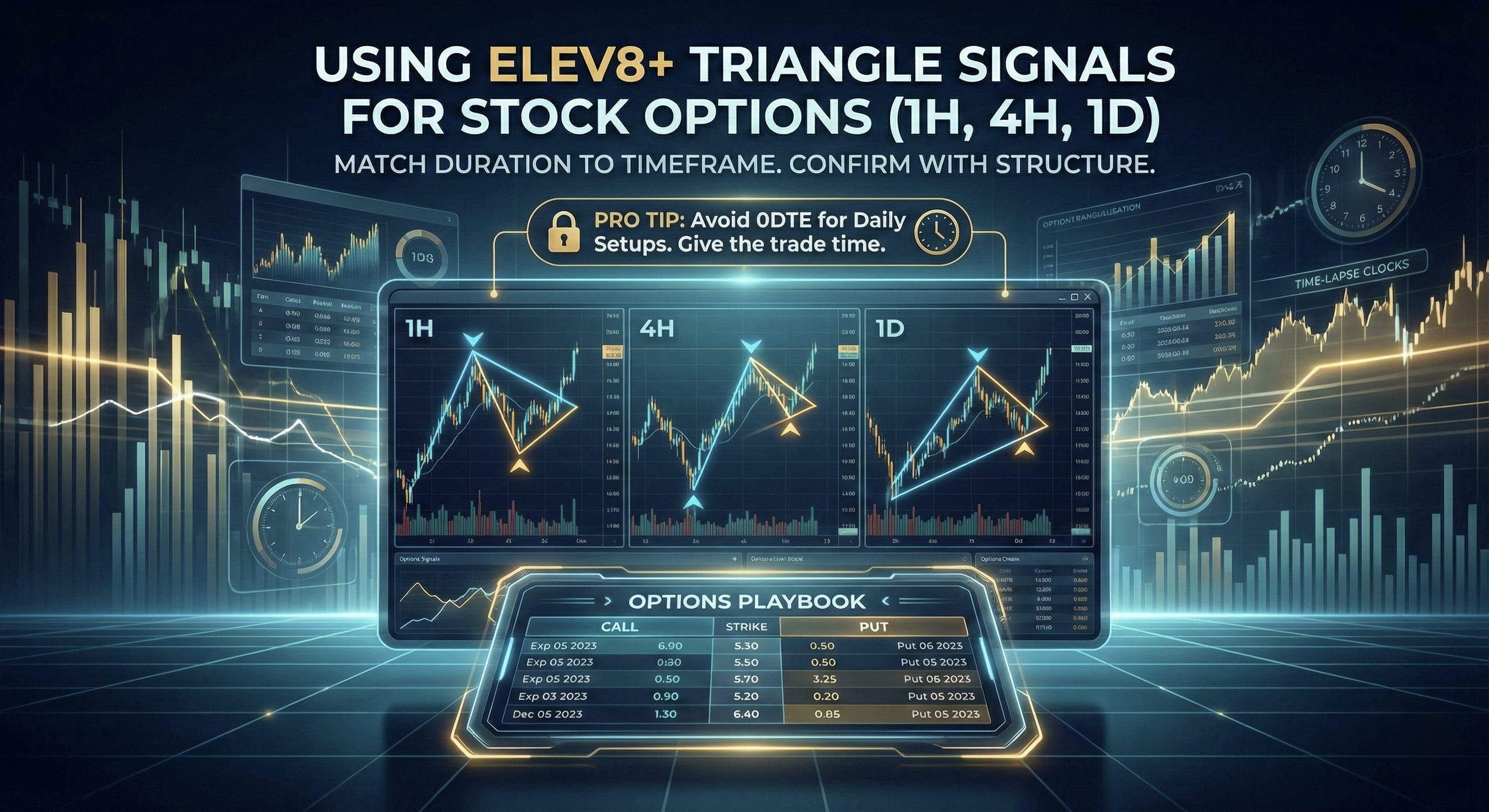

Options Playbook • Higher Timeframes

How to Use Elev8+ Triangle Signals for Stock Options (1H, 4H, and 1D)

Higher timeframe triangles can signal longer trend shifts—but the move may take days (or weeks) to develop. This guide shows how to apply Elev8+ triangles to options by matching your timeframe to contract duration (DTE), using a simple confirmation process, and avoiding common mistakes like forcing 0DTE into a daily thesis.

Educational content only. Options involve risk (including total loss of premium). Not financial advice.

Core idea

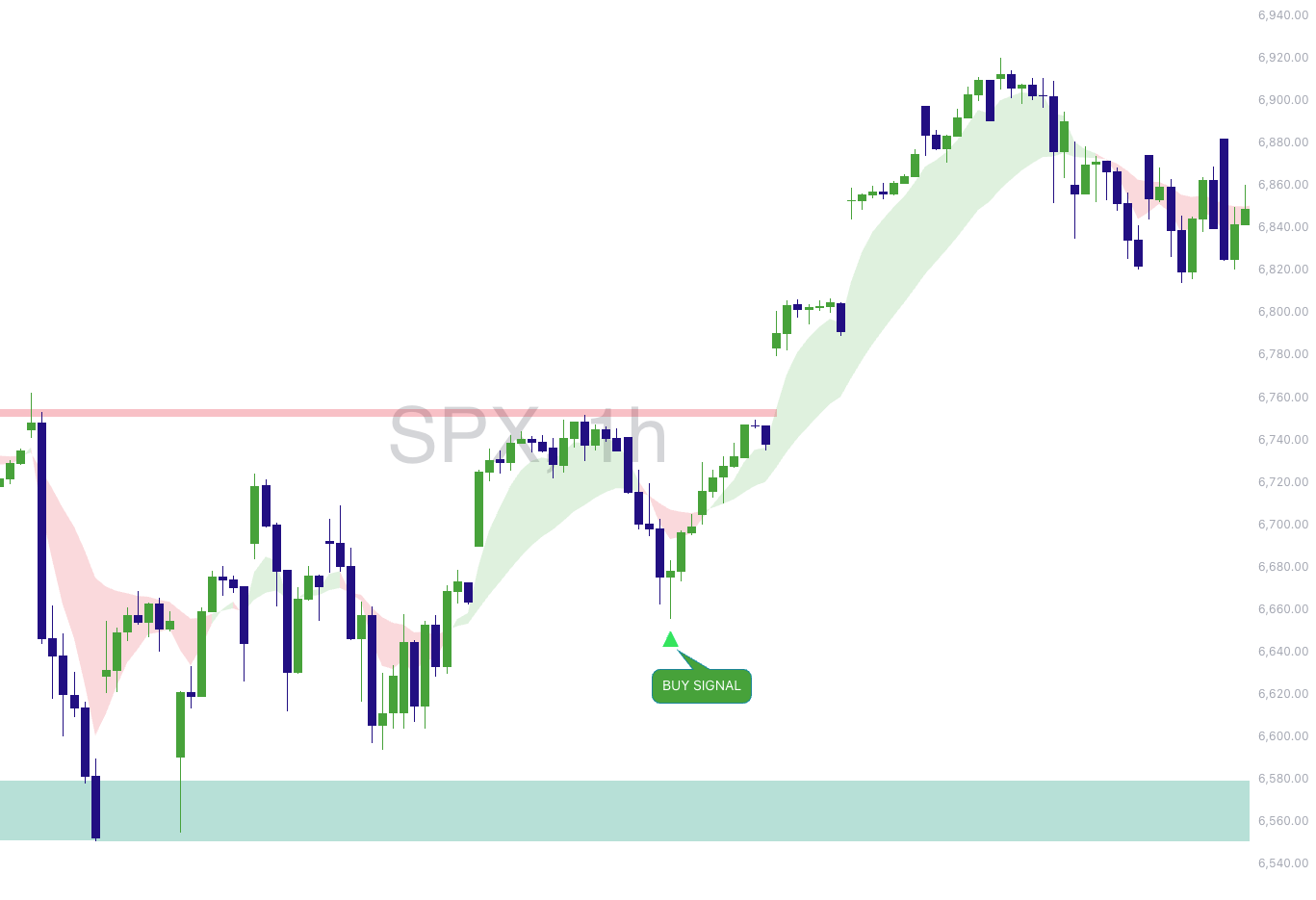

Treat triangles as alerts, then confirm with structure and key levels before choosing a contract.

Contract match

Higher timeframes often need more time. Use longer-dated options (often ATM or slightly OTM) to avoid getting “right” but losing to decay.

0DTE rule

Daily/4H signals can take days. Don’t force them into 0DTE. Reserve 0DTE for lower timeframe day-trading logic.

Example 1: 1D triangle at a major level (swing thesis)

The Big Idea: Match Your Contract Duration to Your Timeframe

A triangle on the 1D chart is not the same as a triangle on the 1m chart. Daily and 4H signals can imply longer shifts, but the move can take time to mature. If your contracts expire too soon, you can be right on direction and still lose due to time decay.

Practical translation

Higher timeframe = more patience required. Give the trade “room in time,” not just room in price.

ATM vs Slightly OTM (and Why It Matters)

Many traders prefer ATM or slightly OTM contracts for higher timeframe signals because they often balance responsiveness (delta) and cost. Deep OTM contracts can be cheaper, but frequently require faster and larger moves to perform well.

Why 0DTE Usually Doesn’t Match 1D / 4H Signals

Higher timeframe signals can be valid even if the stock chops for a few sessions before trending. With 0DTE, you’re forcing a swing thesis into a same-day expiration window—often a poor fit. If you want to trade 0DTE, base it on lower timeframe execution where the expected move is intraday.

Example 2: 4H confirmation (reclaim / structure shift)

Confirmation Workflow: 1D Bias → 4H Structure → 1H Timing

1) 1D = Primary Bias (Location Matters Most)

- Prioritize triangles at meaningful areas: major support/resistance, range extremes, long swing highs/lows.

- Be cautious with triangles printing mid-range with no obvious level context.

- Consider waiting for candle close on the timeframe to reduce noise.

2) 4H = Structure (Is the Reversal Real Yet?)

- Look for a reclaim, failed push, or “shift” in structure.

- Confirm you’re not entering directly into immediate resistance/support that invalidates the thesis.

3) 1H = Timing (Improve Entry, Tighten Risk)

- Prefer entries on pullbacks/retests rather than chasing the first big candle.

- Define a clear invalidation level on the chart (the level that proves the idea wrong).

Example 3: 1H entry timing (pullback + invalidation)

Position sizing

Size options so a full premium loss is acceptable. Defined-risk does not mean low-risk.

Time risk

If the thesis is 1D/4H, don’t buy contracts that require an immediate move to survive.

Invalidation

Always define the price level that proves the signal wrong—then respect it.

When 0DTE Can Make Sense (Lower Timeframes Only)

0DTE is an intraday tool. If you’re using 0DTE, base decisions on lower timeframe context (similar to day trading), and only when you can define tight invalidation and expect the move to occur quickly. If the setup needs “a few days,” it’s not 0DTE.

Common Mistakes (and How to Fix Them)

- Mistake: using short-dated options for daily signals. Fix: match DTE to timeframe and thesis duration.

- Mistake: buying mid-range triangles. Fix: prioritize major levels and range extremes.

- Mistake: skipping confirmation. Fix: treat triangles as alerts; confirm with structure/levels.

- Mistake: no invalidation plan. Fix: define the exact chart level that proves you wrong.

Options are complex and carry risk. Examples are for educational purposes only and are not trade recommendations. You are responsible for all decisions and risk management.