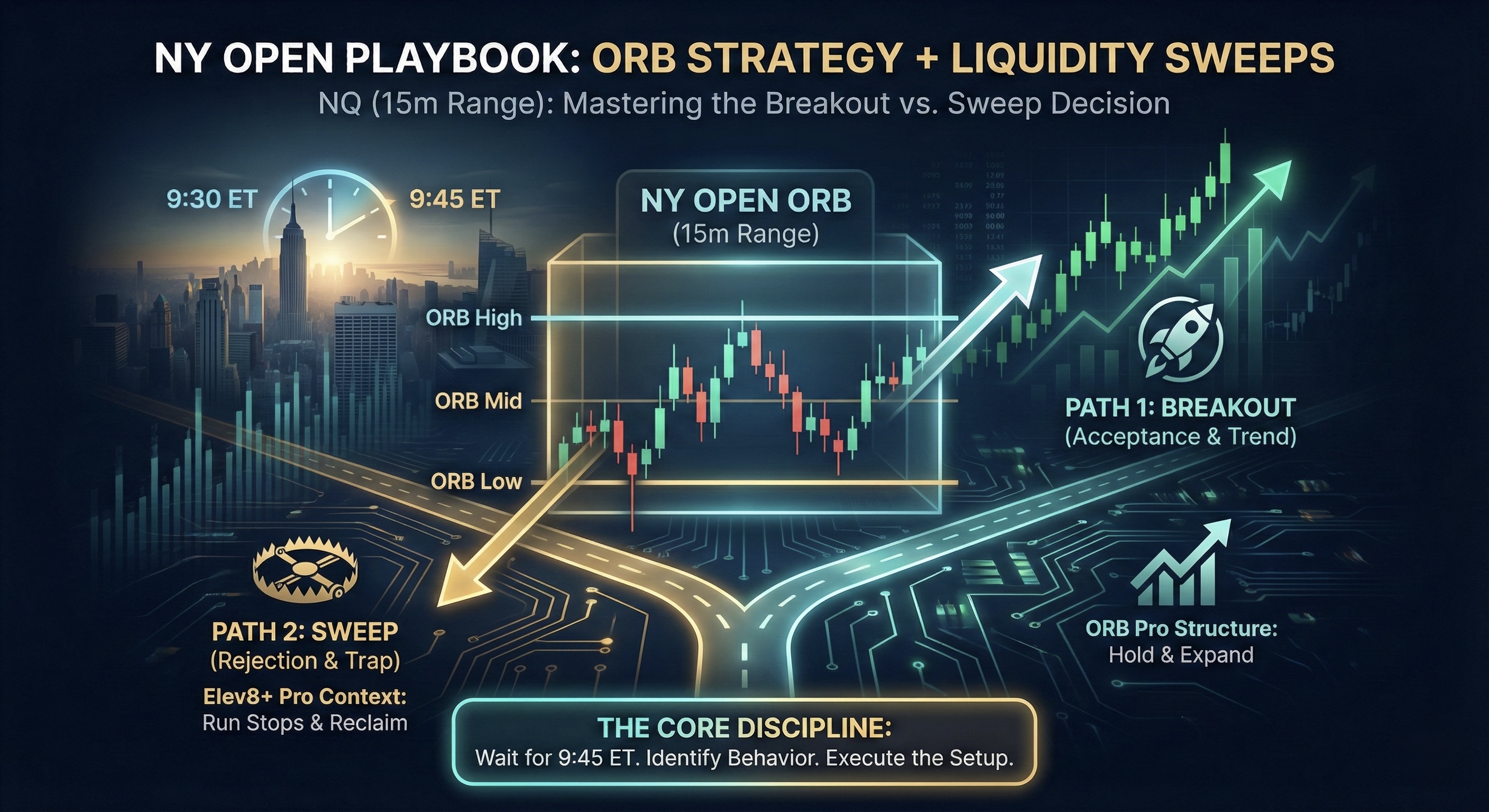

NY Open Playbook • ORB Strategy + Liquidity Sweeps

The NY Open ORB Strategy for NQ (15m Range): Breakouts vs Sweeps, and How to Trade Both

The NY open is where many traders get chopped up—not because the market is “random,” but because it rotates between two very different behaviors: true expansion (ORB breakout) and liquidity runs (sweep-and-reverse). This post breaks down how to tell them apart, why each behavior happens, and how to use ORB Pro and Elev8+ Pro as tools to trade the strategy with structure.

Educational content only. Not financial advice. No performance guarantees.

Core idea

The market usually does one of two things after the ORB completes: accepts outside (trend) or rejects back inside (trap).

Tooling

ORB Pro defines the range and breakout structure. Elev8+ Pro helps read sweeps, exhaustion, and reversal context.

Best habit

Treat 9:45 ET as the decision point. Let the ORB complete, then trade the behavior: acceptance or rejection.

Why the NY Open ORB works

The first 15 minutes of the NY cash open (9:30–9:45 ET) is a concentrated window of liquidity and order-flow imbalance: overnight positioning meets cash-session volume, spreads tighten, and large participants execute into predictable pockets of resting orders. That creates a simple reality:

- The ORB becomes a shared reference level (many traders and systems react to the same high/low).

- Liquidity builds at obvious boundaries (stops above highs, stops below lows, breakout entries stacked).

- Price often chooses between two outcomes: expand with acceptance (trend) or run stops and snap back (trap).

A simple way to think about the open

The market uses the ORB to discover whether there’s real demand/supply outside the range. If there is, it accepts and trends. If not, it often “tests” liquidity (sweeps) and rotates back into balance.

Premarket ORB vs NY Open ORB: which range matters more?

For NQ, the NY cash open 15m ORB (9:30–9:45 ET) is generally the most important range for intraday direction, because it forms during the highest-impact transition into the cash session.

The first 30 minutes of premarket (8:00–8:30 ET) is still useful, but mostly as context: it often marks early liquidity pools, compression/expansion clues, and levels that get swept right around the cash open.

Practical ranking (most days)

- NY Open 15m ORB (9:30–9:45 ET) — primary structure for acceptance/rejection.

- Overnight range (ON high/low) — major liquidity reference, often swept near the open.

- Premarket 30m (8:00–8:30 ET) — secondary levels; useful for sweep targets and confluence.

The two NY open behaviors you must separate

Most traders get trapped because they try to trade one playbook in the wrong environment. At the NY open, price tends to fall into one of these two buckets after the ORB completes:

1) ORB Breakout Day (acceptance → trend)

This is when price breaks the ORB high/low and holds outside. The defining feature is acceptance: pullbacks respect the ORB boundary (or the ORB midline), and expansion continues.

2) ORB Trap Day (sweep → rejection → reversal or chop)

This is when price breaks the ORB boundary, runs stops (liquidity sweep), and then reclaims back inside. The defining feature is rejection: the market “tests” liquidity outside the ORB but cannot sustain it.

NY Open Decision Tree (simple)

Step 1: Let the ORB complete at 9:45 ET.

Step 2: If price breaks ORB and accepts outside → trade ORB breakout continuation.

Step 3: If price breaks ORB and then reclaims inside (especially after a sweep) → trade ORB trap / reversal.

This is a framework for analysis and education. Always define risk and trade only what fits your plan.

Should you trade immediately at 9:45 or wait?

If you want consistency, use 9:45 ET as the “information checkpoint.” Trading before the ORB completes is possible, but it’s also where most false breaks and open volatility traps happen.

A practical approach that reduces fakeouts

- At 9:45: mark ORB high/low/mid and observe the first push outside the ORB.

- Wait for either: (a) acceptance (hold outside) or (b) rejection (reclaim inside).

- Then execute the play that matches the behavior.

Strategy A: ORB breakout continuation (trend day play)

Your edge on a breakout day is not “it broke, so I buy/sell.” Your edge is: break + acceptance + structure.

Entry concepts (pick one and stay consistent)

- Retest entry: price breaks ORB, pulls back to the boundary, then holds (cleanest).

- Hold entry: price breaks ORB and consolidates outside (enter on continuation trigger).

- Momentum entry: immediate break with strong follow-through (highest risk of fakeout).

Targets

- ORB range projections: 1x and 2x of the ORB range (simple and objective).

- Liquidity targets: ON high/low, premarket highs/lows, prior day levels (if you use them).

Strategy B: ORB sweep-and-reclaim (trap day play)

Trap days often punish breakout traders early. The market runs stops above/below the ORB, then snaps back. The “tell” is simple: it cannot hold outside the ORB.

What you want to see

- Sweep: a fast poke beyond ORB high/low (or an ON level), often wicky.

- Reclaim: price returns back inside the ORB and holds.

- Follow-through: rotation toward ORB mid, then potentially the opposite ORB boundary.

Targets

- First target: ORB midline (common magnet).

- Second target: opposite ORB boundary (if rejection is clean).

- Context targets: fill of the sweep impulse, return to key levels inside the range.

Stop loss types (choose what fits your style)

There are multiple valid stop styles. The key is to match your stop to the strategy you’re trading.

Wick-based stop

Place the stop beyond the sweep wick (trap play) or beyond the retest low/high (breakout play). Tight and clean, but can be hit in high volatility.

Structure stop

Stop beyond ORB boundary/midline or a confirmed structure point. More durable, but wider.

Volatility stop

Use ATR/volatility sizing to avoid noise. Requires consistent sizing and risk control.

How ORB Pro and Elev8+ Pro fit into the strategy

The strategy is the edge. The indicators are tools that make the strategy easier to execute consistently.

ORB Pro: structure, levels, and objective breakouts

- Draws the ORB (NY 15m by default) so your levels are consistent every day.

- Extends levels forward so you can trade the reaction later, not just during the window.

- Breakout method: use Close for cleaner confirmation, Wick for earlier (but noisier) triggers.

- Targets: optional 1x and 2x projections help standardize exits and reduce “guessing.”

Elev8+ Pro: sweep context, exhaustion, and reversal structure

- Highlights liquidity sweeps and helps you recognize “breakouts that are actually stop-runs.”

- Shows structured reversal context so you can avoid fading a true trend day too early.

- Pairs well with ORB because many sweeps happen at ORB boundaries, ON highs/lows, and obvious session levels.

Combined playbook (how to actually use both)

If price breaks ORB and holds outside: ORB Pro becomes primary (breakout structure). Use Elev8+ Pro as a filter to avoid chasing an obvious sweep trap.

If price breaks ORB and reclaims inside after a sweep: Elev8+ Pro becomes primary (sweep/reversal context). Use ORB Pro for invalidation and targets (midline, opposite boundary).

Common NY open mistakes (and the fixes)

-

Mistake: treating every ORB break as a trend day.

Fix: require acceptance outside the ORB or a retest hold before sizing up. -

Mistake: fading every push outside the ORB instantly.

Fix: wait for reclaim inside the ORB (rejection) before taking the trap play. -

Mistake: no standardized targets or exits.

Fix: use ORB midline / opposite boundary and/or 1x/2x projections to stay systematic.

What to journal (to improve the strategy fast)

If you want this strategy to compound over time, your journal should track behavior, not just P&L:

- Did price accept outside the ORB or reject back inside?

- Was there a visible sweep (wick, fast run, immediate snap back)?

- Where was the open relative to the overnight range (inside vs outside)?

- Which stop type did you use and did it match the play (breakout vs trap)?

Want to see this on real charts?

Watch the Elev8+ demo to see how the sweep/reversal context and structured visuals look in real time, and use ORB Pro to define the NY open ORB ranges and breakout levels consistently.

Indicators and examples are provided for educational purposes only and are not trade recommendations. You are responsible for all decisions and risk management.