The Professional’s Daily Routine: Prep, Levels & Execution Windows

Amateur traders open their charts at 9:30 AM and react to whatever moves. Professionals know the trade is won before the market even opens.

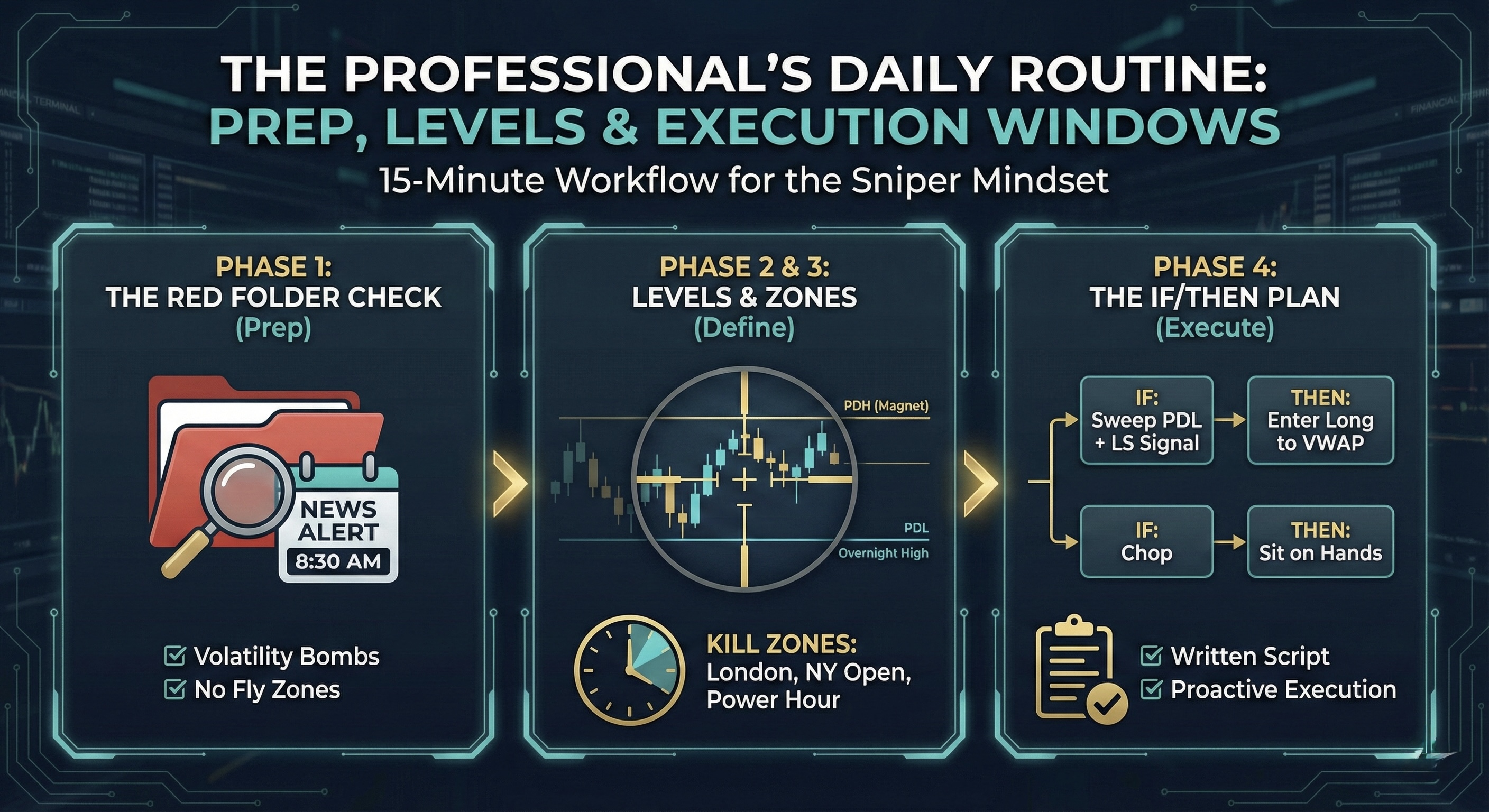

The Elev8+ system is designed to remove the guesswork, but it requires a routine to function. This guide breaks down the exact 15-minute workflow you should follow every single day to identify your levels, define your windows, and execute with the "Sniper Mindset."

The 15-Minute Promise

If you cannot build your plan in 15 minutes, you are overcomplicating it. Complexity is the enemy of execution.

This workflow works with Elev8+ Pro alone, but it becomes more objective with the full suite: Market Map helps you confirm the real magnets (sessions/VWAP/HTF levels), Market Extremes helps you avoid mid-range chop and focus on boundary reactions, and Momentum Gaps helps you map rotation checkpoints and targets once a sweep confirms.

Phase 1: The "Red Folder" Check (Time: 2 Minutes)

Before you even look at a chart, you must know if a volatility bomb is scheduled. Check an economic calendar (like ForexFactory) for high-impact news.

- CPI / PPI / FOMC / NFP: These are "No Fly Zones." Do not have an active trade open during the release.

- 8:30 AM or 2:00 PM EST: The most common times for algorithmic volatility spikes.

The Rule

If a major report is due at 8:30 AM, do not place a level-based trade at 8:29 AM. Wait 15 minutes for the dust to settle, then trade the reaction (often a sweep of the news candle).

Phase 2: The "Core Six" Levels (Time: 5 Minutes)

Sweep Levels+ removes manual line drawing, but enabling every level creates paralysis. Your execution chart should feel like a sniper's scope, not a spiderweb.

Open your settings and enable ONLY these levels. If a level is far away from price, hide it.

- 1. PDH (Prior Day High) — The #1 Magnet.

- 2. PDL (Prior Day Low) — The #1 Magnet.

- 3. Overnight High — Key for the morning session.

- 4. Overnight Low — Key for the morning session.

- 5. Weekly High/Low — Only if price is nearby.

- 6. Session High/Low — (Asia or London extremes).

Pro Tip: Use the "Visual Settings" to make Tier 1 levels (PDH/PDL) thicker and solid, and Tier 2 levels (Overnight) thinner and dashed. Visual hierarchy speeds up decision making.

Optional: Use Market Map as a “sanity check” so you don’t overweight minor levels. The goal is to keep your execution chart clean while still respecting major session structure, VWAP, and nearby HTF magnets.

Phase 3: Define Your "Kill Zones" (Time: 3 Minutes)

Liquidity is not harvested evenly throughout the day. Institutional volume clusters in specific windows. Mark these times mentally or on your chart.

- Goal: Watch for a sweep of the Asia High/Low.

- Why: Often sets the high or low for the pre-market session.

- Goal: Watch for a run on the Overnight or Prior Day levels.

- Why: The most emotional window. The "Judas Swing" (fake move) usually happens here.

- Goal: End-of-day mean reversion or stop hunts.

- Why: Institutions rebalancing books before the close.

⚠️ The "Dead Zone": NY Lunch (12:00 PM – 1:30 PM EST)

Do not initiate new trades here. Volume drops, algorithms chop price, and clean sweeps turn into slow bleeds. Use this time to journal your morning trades or walk away.

Optional: Use Market Extremes to reduce “random clicking” inside mid-range chop. Your best sweep trades usually form near boundaries; when you’re in the middle, patience is part of the edge.

Phase 4: The "If/Then" Plan (Time: 5 Minutes)

A plan is not a prediction ("I think NQ goes up"). A plan is a conditional reaction ("If X happens, I do Y").

- Scenario A (Bullish): "IF price sweeps the PDL and prints an LS Buy Signal, THEN I enter long targeting VWAP."

- Scenario B (Bearish): "IF price runs the Overnight High into the Open and rejects, THEN I enter short targeting the mid-range."

- Scenario C (No Trade): "IF price chops between PDH and PDL all morning, THEN I sit on my hands."

Write these down. Physically writing them engages a different part of your brain and reduces impulsive clicking.

Optional: Use Momentum Gaps to define “rotation checkpoints” for targets. Instead of guessing where to take profit, map the path (VWAP, midpoint, gap fills, and the next magnet).

Summary: The Daily Checklist

- ✅ News Checked? (Aware of 8:30am/2:00pm drops).

- ✅ Core Six Levels Loaded? (Clean chart, no clutter).

- ✅ Time Window Open? (Not trading during Lunch).

- ✅ If/Then Scenarios Written? (I know exactly what I am waiting for).

This routine turns trading from a reactive, stressful video game into a proactive, professional business. Plan the trade, then trade the plan.