Trade Management & Exit Strategy: Partials, Trailing & When to Cut

Most traders obsess over entries but lose money on exits. They hold losers too long hoping for a turnaround, or they choke winners too early out of fear.

Elev8+ provides the entry signal, but Trade Management provides the paycheck. This guide defines the strict rules for managing a trade once you are in it. No guessing. No emotion. Just execution.

The Golden Rule of Reversals

Elev8+ trades are Rotations (Sweep → Mean), not Trends.

Rotation trades have a high probability of hitting the first target, but a lower probability of running forever.

We pay ourselves early.

You can manage trades with Elev8+ Pro alone, but the full suite makes exits more objective: Market Map helps define the next “magnet” beyond VWAP, Market Extremes helps decide when to take profits faster (chop) vs let runners work (boundary shifts), and Momentum Gaps helps set rotation checkpoints (gap fills / inefficiencies) so you’re not guessing targets.

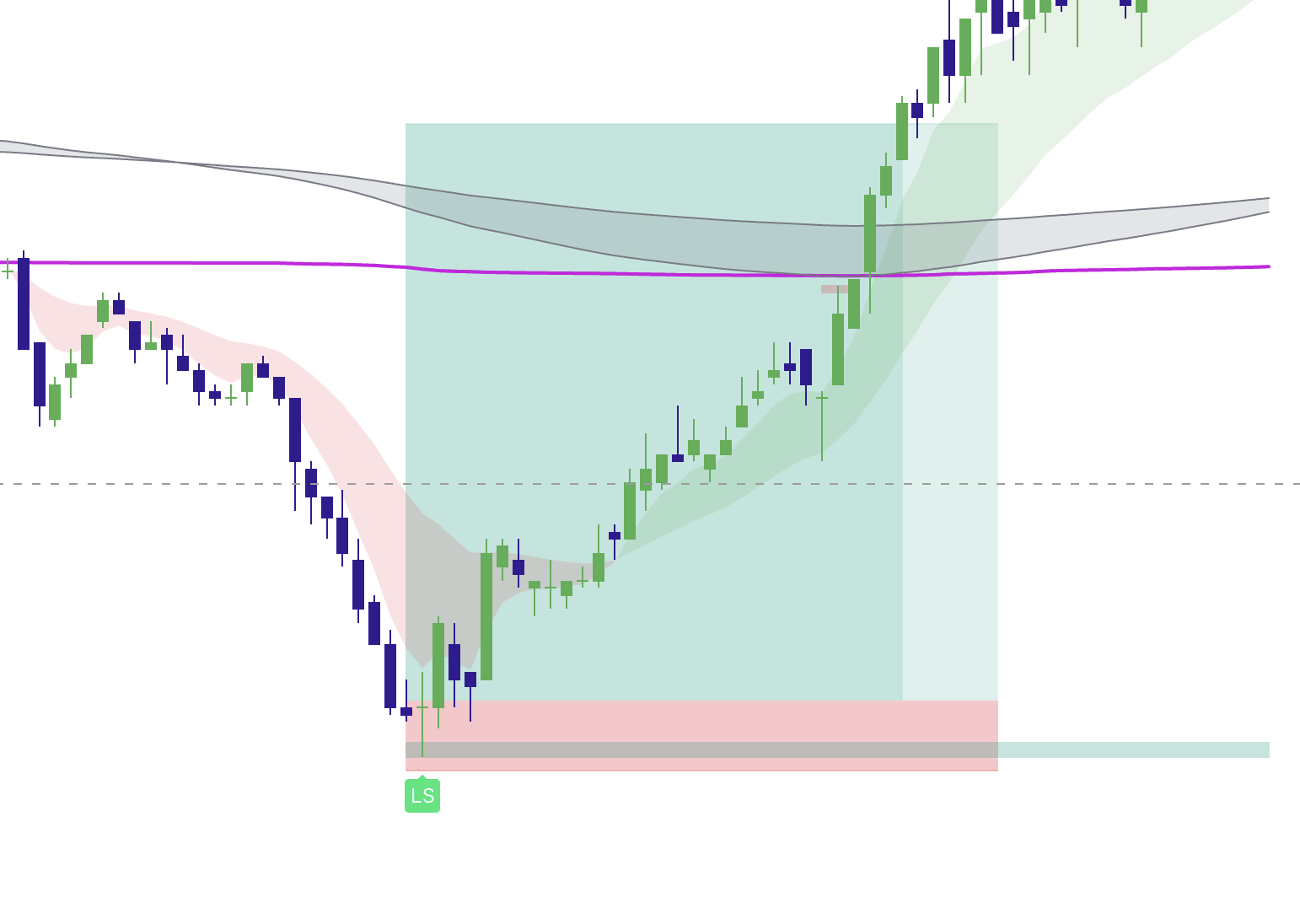

Rule 1: The Hard Stop (Invalidation)

Before you enter, you must accept where you are wrong. In a sweep trade, this is black and white.

Your Stop Loss goes 1-2 ticks beyond the Sweep Wick.

- Why? The wick represents the "Trap." If price breaks the wick, the trap has failed, and the market is breaking out.

- The Mistake: Do not widen your stop because "it looks close." If it hits the wick, the thesis is dead. Get out.

Rule 2: The "Paycheck" (Taking Partials)

Since we trade rotations, we must capture the meat of the move. We recommend the 75/25 Split.

- When price hits VWAP or the Mid-Range, close 75% of your position.

- Why? This is the highest probability objective. Bank the profit. This guarantees a winning trade and pays for your mental capital.

Optional: If you use Momentum Gaps, treat gap fills/inefficiencies as “rotation checkpoints” on the way to VWAP/mid-range. If you use Market Map, confirm the next nearby magnet so your Target 1 isn’t floating in empty space.

- Leave the remaining 25% to run to the Opposing Structure (e.g., from PDL to PDH).

- Why? Occasionally, a rotation turns into a massive trend reversal. This small runner catches the "Home Run" without the stress.

Rule 3: Breakeven (The "Free Ride")

Moving your stop to Breakeven (BE) protects your account, but moving it too early destroys your edge.

Only move your stop to Breakeven AFTER you have taken your first partial (Target 1).

- If you move to BE before hitting VWAP, normal market noise will stop you out before the move completes.

- Once you bank 75% at VWAP, move the remaining runner to BE. Now the trade is risk-free and stress-free.

Rule 4: The "Professional Cut" (Advanced Skill)

Sometimes a trade isn't "wrong" (didn't hit the stop), but it isn't "right" either. Professional traders cut these trades early to save capital.

- The Stall: Price sweeps, confirms, but then sits at the entry price for 3+ candles without moving. (Reversals should be fast).

- The Grind: Price starts making "lower highs" (for a long setup) against you, slowly grinding toward your stop.

- The News: You forgot a news event is in 5 minutes. Close it immediately.

The 5-Minute Rule

If the trade hasn't moved in your favor within 5 minutes (on a 1m/5m chart), the probability of success drops by 50%. Consider cutting or reducing size.

Rule 5: Trailing the Runner

For that final 25% runner, do not trail aggressively. Give it room.

- Don't: Trail bar-by-bar (you will get wicked out).

- Do: Trail behind Market Structure. Only move your stop up when a new Higher Low is confirmed and broken to the upside.

Optional: Use Market Map to trail behind meaningful structure/magnets (not micro noise), and use Market Extremes to tighten faster during chop regimes.

Summary: The Management Checklist

- Entry: I am in the trade.

- Protection: Hard Stop is set at the Sweep Wick.

- First Objective: Limit order set at VWAP to close 75%.

- Wait: I do nothing until Stop or Target is hit. (No fiddling!).

- Success: VWAP hit. 75% closed. Stop moved to Breakeven.

- Bonus: Runner left to hit the next major level.

Trading is not about being right. It is about making money when you are right, and losing little when you are wrong. Follow this protocol, and you turn trading into a business.