Elev8 sweep reversals are powerful when executed correctly. New users often get excited, take every triangle or premium label they see, and quickly learn that context matters just as much as confirmation. This guide highlights the most common beginner mistakes and the best practices that turn Elev8 into a consistent, structured trading edge.

Beginner mindset shift

Elev8 is not designed to be traded at high frequency. It is designed to help you identify high-quality liquidity events so you can be selective, disciplined, and consistent.

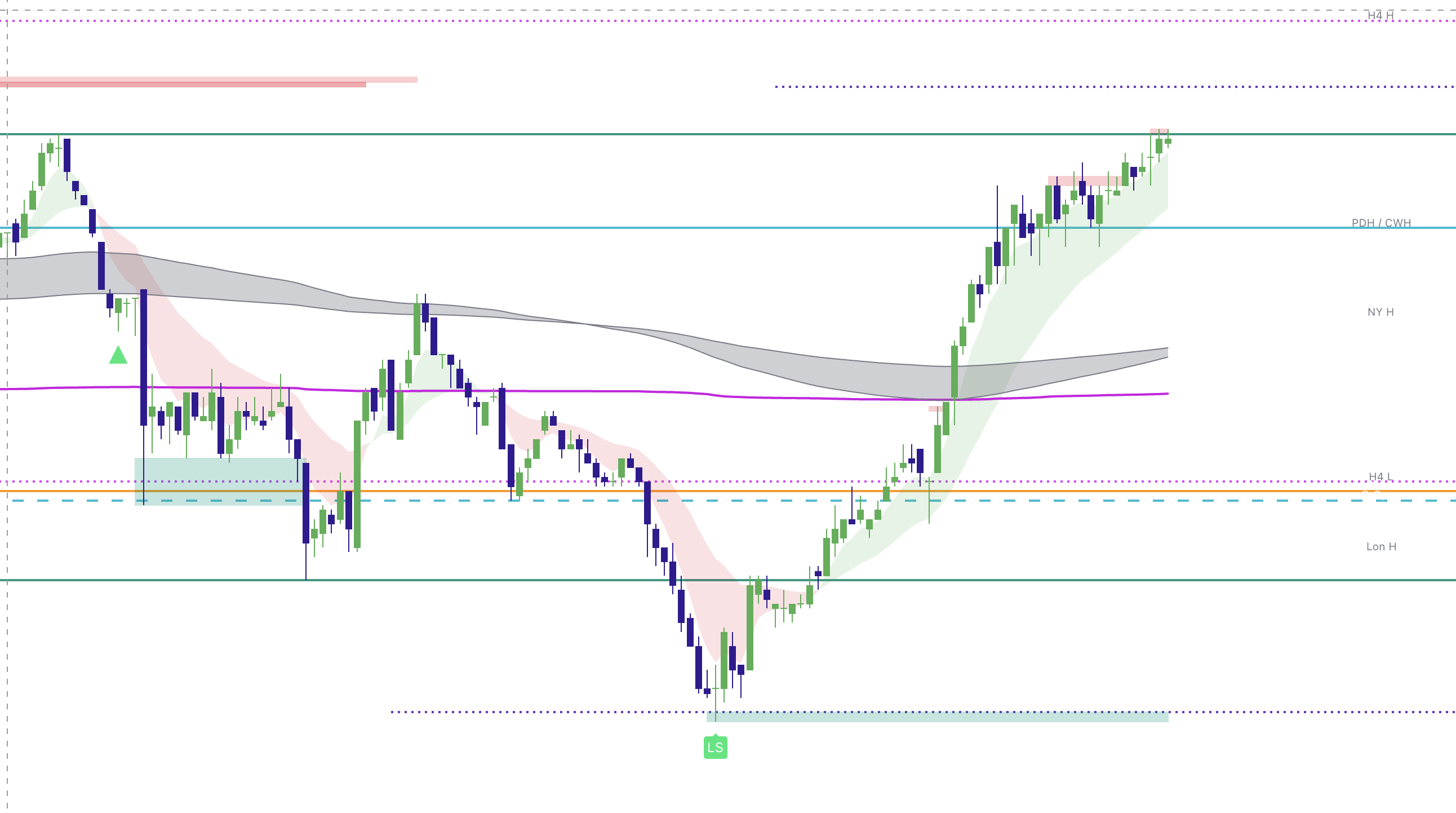

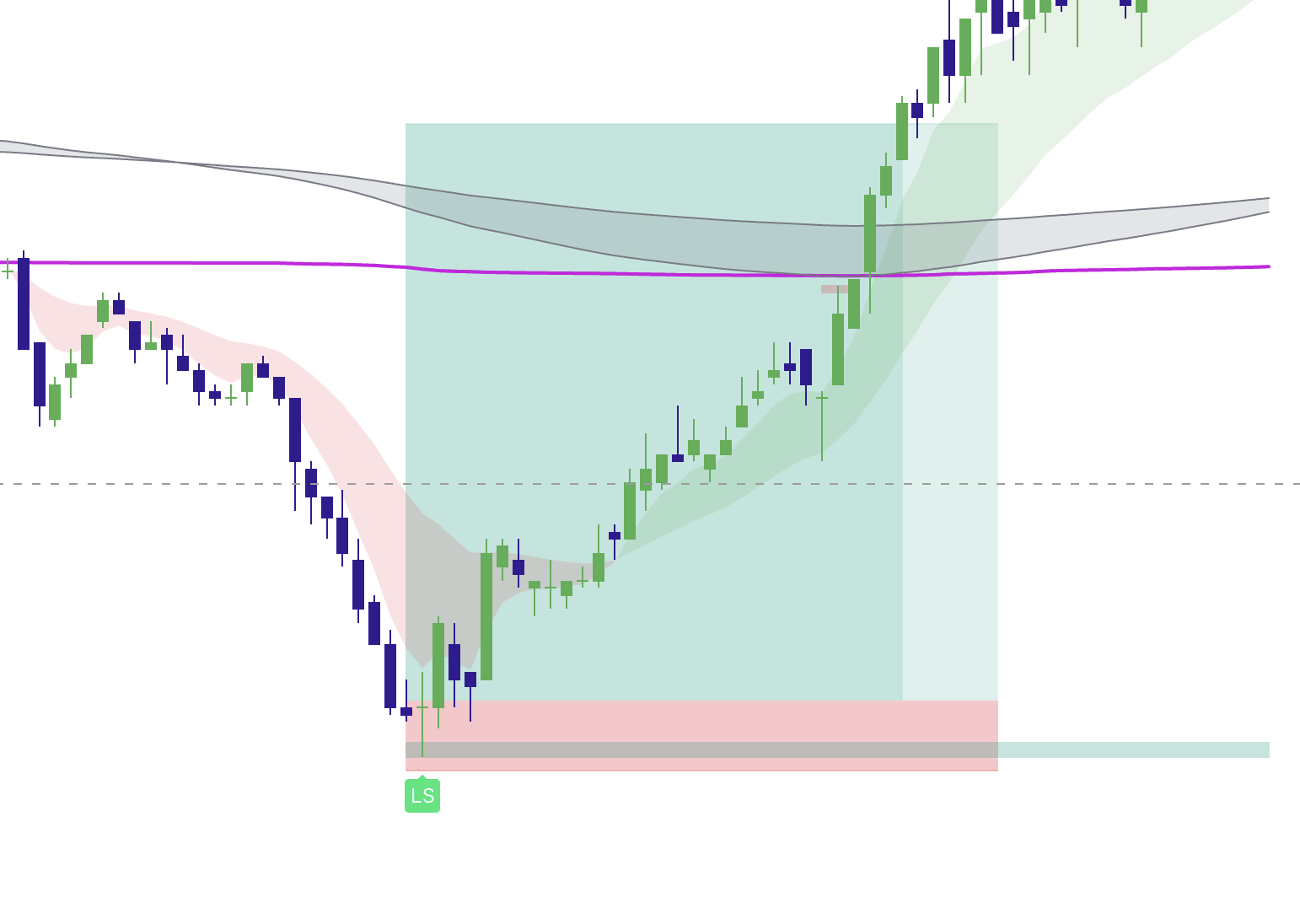

- Gate 1 — Location: The sweep must occur at a real liquidity magnet (PDH/PDL, session extremes, weekly/monthly, ONH/ONL).

- Gate 2 — Rejection: A clean wick through the level + close back inside (not acceptance outside).

- Gate 3 — Confirmation: Triangle (alert) or LS (premium) prints at/near the sweep zone.

Optional confluence (if you use the full suite): Market Map helps confirm magnets + VWAP/value targets, Market Extremes helps you avoid fading strong regime expansion, and Momentum Gaps helps separate rejection/rotation from acceptance/continuation.

Mistake 1: Taking Sweeps Without a Major Level

Elev8 identifies sweep behavior automatically, but not all sweeps carry the same weight. A sweep becomes meaningful when it attacks a level that has real liquidity pressure behind it.

- Tier 1: Prior Day High / Low, Weekly / Monthly extremes

- Tier 2: Asia / London / New York session highs and lows, Overnight high/low

- Tier 3: Local pivots / minor intraday structure (lowest priority)

If there is no meaningful level at the sweep, skip it. Random sweeps inside chop often produce messy follow-through and low clarity.

Mistake 2: Entering During the Run (FOMO)

One of the fastest ways to lose confidence is entering while price is still attacking the level. At that moment, liquidity is actively being harvested and the reversal story is not confirmed.

- You are trading into active stop hunting (unfinished liquidity event)

- The rejection wick may not be complete

- Price can still extend before it resets

Best practice: wait for the sweep to complete and the bar to close. Elev8 is designed to confirm rejection after the sweep, not during it.

Mistake 3: Ignoring Wick Structure

The wick is not just cosmetic. It is often the clearest visual proof that liquidity was harvested and rejected.

Weak sweep candles often show:

- Short or indecisive wicks

- Large bodies that close near the extreme (acceptance risk)

- Messy structure inside tight ranges (micro-noise)

Simple rule

If the wick is weak, the sweep is weak. Prioritize clean, emotional rejection structure at real magnets.

Mistake 4: Using Loose or Random Stop Placement

Sweep reversals offer one of the cleanest intraday risk models because the invalidation point is naturally defined.

- Place your stop 1–2 ticks beyond the sweep wick extreme.

This creates a stop placement that is:

- Tight

- Logical

- Aligned with your thesis

Beginners reduce execution quality by using wide, arbitrary stops that break the structure-based risk advantage Elev8 is designed to provide.

Mistake 5: Taking Every Triangle You See

Triangles are frequent by design. They are the system’s way of highlighting potential sweep environments. The mistake is treating all of them as equal.

- Triangle: First alert (you still must verify level + rejection).

- LS label: Premium confirmation (more selective environment; better for beginner sizing).

Triangles become higher quality when:

- A major level is present

- The rejection wick is clean and emotional

- Participation and session timing support the move

Think of triangles as the system saying: "Pay attention here." Your job is to decide whether the environment is worth trading.

Mistake 6: Over-Trading (The "Casino" Approach)

Elev8 is a tool for identifying reversals. True institutional reversals do not happen 20 times a day. If you are taking 5, 10, or 15 trades in a single session, you are likely trading noise, not signal.

Over-trading increases fees, but the bigger problem is decision fatigue. The quality of your filtering drops with every forced trade.

The 2-Loss Rule

If you take two full stops in a row, stop trading for the session. Consecutive losses usually mean conditions (e.g., strong trend/acceptance) do not match the reversal framework. Preserve capital and reset the next day.

Mistake 7: Undervaluing Premium Confirmations

New traders sometimes overlook LS labels or assume they are just another triangle. In practice, LS labels are designed to represent a more selective sweep environment.

- More selective conditions

- Cleaner structural context

- Better suited for disciplined sizing while learning

If you are still building confidence, prioritize LS confirmations until your read on level context and wick quality is consistent.

Mistake 8: Trading During Low-Participation Hours

Elev8 works best when markets are emotional and rotating through meaningful liquidity. Weak conditions often include:

- Slow overnight hours without catalysts

- Midday consolidation with low intent

- Sweeps inside tight micro ranges

Higher-quality sweeps often emerge when the market transitions between sessions and liquidity is actively being built and harvested.

Timing is part of the edge

If your setup is strong but participation is low, your best decision may be to wait for a better window.

Mistake 9: Overcomplicating the Chart

Sweep Levels and liquidity frameworks are powerful, but beginners often turn on too many level types at once. This creates visual overload and weak decision-making.

Best practice:

- Identify a small set of the most important levels for the session

- Hide the rest

- Focus on clarity over quantity

Less noise improves precision, confidence, and execution speed.

Best Practices for New Elev8 Users

Use this as your baseline rule set while you build experience:

- Quality over Quantity: Limit yourself to 2–3 “A+” setups per day.

- Only trade sweeps at meaningful levels (Tier 1–2 preferred).

- Wait for bar close and confirmed rejection (close back inside).

- Place stops beyond the sweep wick (no mental stops).

- Frame first targets around mean/VWAP or mid-range rotation.

- The 2-Strike Rule: Stop trading after 2 consecutive losses.

- Journal: Screenshot every setup and write why it was valid or invalid.

Consistency improves dramatically when you treat Elev8 as a quality filter, not a signal generator.

Summary

Key takeaways

- A sweep without a level is usually noise

- A sweep without clean rejection is incomplete

- Bar close matters for confirmation discipline

- Wick extremes define your most logical invalidation points

- Over-trading is the enemy of consistency

- LS confirmations are ideal for selective learning and sizing

Elev8 is a powerful liquidity system, but beginners must learn to avoid randomness and focus on the highest-quality environments. Once those habits form, sweep reversals become one of the clearest and most repeatable intraday frameworks available.