Why Liquidity Sweeps Matter on NQ Futures

If you trade Nasdaq futures (NQ) for more than a week, you will notice a familiar pattern: price pushes through an obvious previous session high or low, triggers stops, then snaps back in the opposite direction. That behavior is often a liquidity sweep.

Quick definition

A liquidity sweep is a fast probe beyond a well-known high/low that triggers resting stops, followed by rejection back into the prior range—often trapping late breakout entries and fueling large order for the true direction.

A sweep is not random volatility. It is frequently a targeted run on resting orders: buy stops stacked above highs and sell stops resting below lows. When those orders trigger, they provide the fuel larger participants need to build positions at better prices.

Suite note: Elev8+ Pro is your timing layer (signals + sweep levels). Market Map, Market Extremes, and Momentum Gaps are optional context layers that help answer: Where is the sweep happening? (Map) Is it a boundary or chop? (Extremes) Where can it rotate? (Gaps).

In practice, Elev8+ helps you frame sweeps with:

- Key sweep levels – automatic session highs/lows, prior day levels, and key pivots.

- Real-time sweep detection – candles that pierce levels then close back inside.

- Optional order-flow + CVD context – to help separate clean reversals from noise when you use those tools.

How Liquidity Sweeps Form on NQ (The Anatomy)

Liquidity sweeps on NQ often follow a simple sequence. Understanding this prevents panic:

- Liquidity builds – Price consolidates near an obvious swing high/low. Retail traders position their stops just beyond it; algorithms wait.

- The Run (The Trap) – One or two impulsive candles drive through the level. This triggers the stops and lures in "breakout traders." Volume spikes.

- Absorption + Rejection – Instead of continuing, the move stalls. Larger participants absorb the flow. Wicks print, and the candle closes back inside the level.

- The Real Move – Price rotates in the opposite direction of the breakout, leaving the late traders trapped at the extremes.

The edge is not in guessing which direction price will probe first. The edge is in waiting for the sweep to finish and trading the reaction.

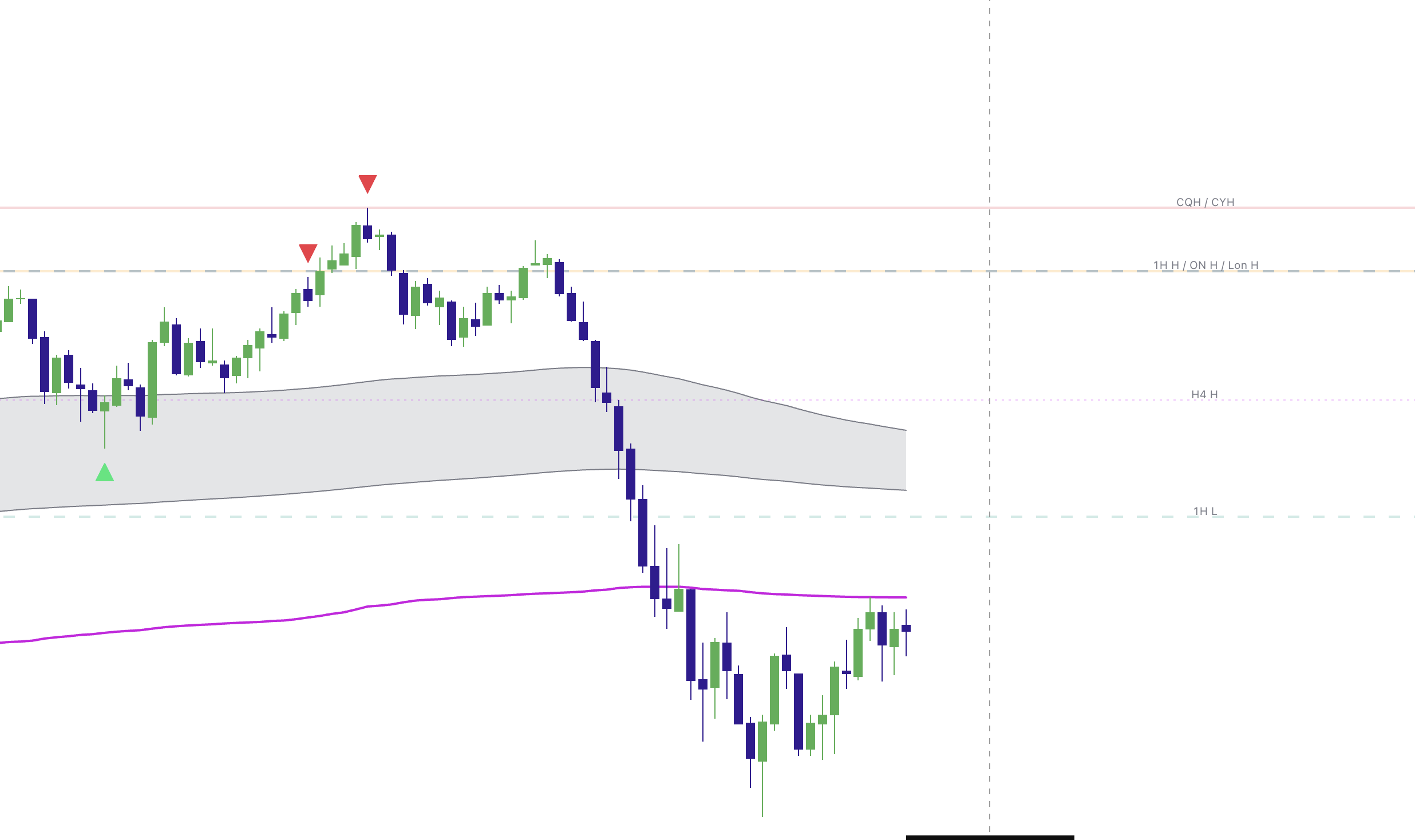

Crucial: When is a Sweep actually a Breakout?

This is where most beginners lose money. They short a "sweep" that is actually a strong trend breakout. You must know the difference.

Watch the candle close relative to the level:

- Valid Sweep: Price pierces the London low but the next candle shows a strong wick rejection and buy signal then quickly closes back inside the range.

- Invalid (Breakout): The candle body closes strongly outside the level and holds. The signal candle is a weak doji candle and price does not quickly return back inside London range. Also if you notice before the bearish breakout we had strong wicks to the upside showing buyers tried to take control and failed before the breakout.

Pro Tip: Avoid News Events

During high-impact news (CPI, FOMC, NFP), sweeps often fail because the momentum is too strong. Do not fade strong news candles even if they hit a level. Wait for the dust to settle.

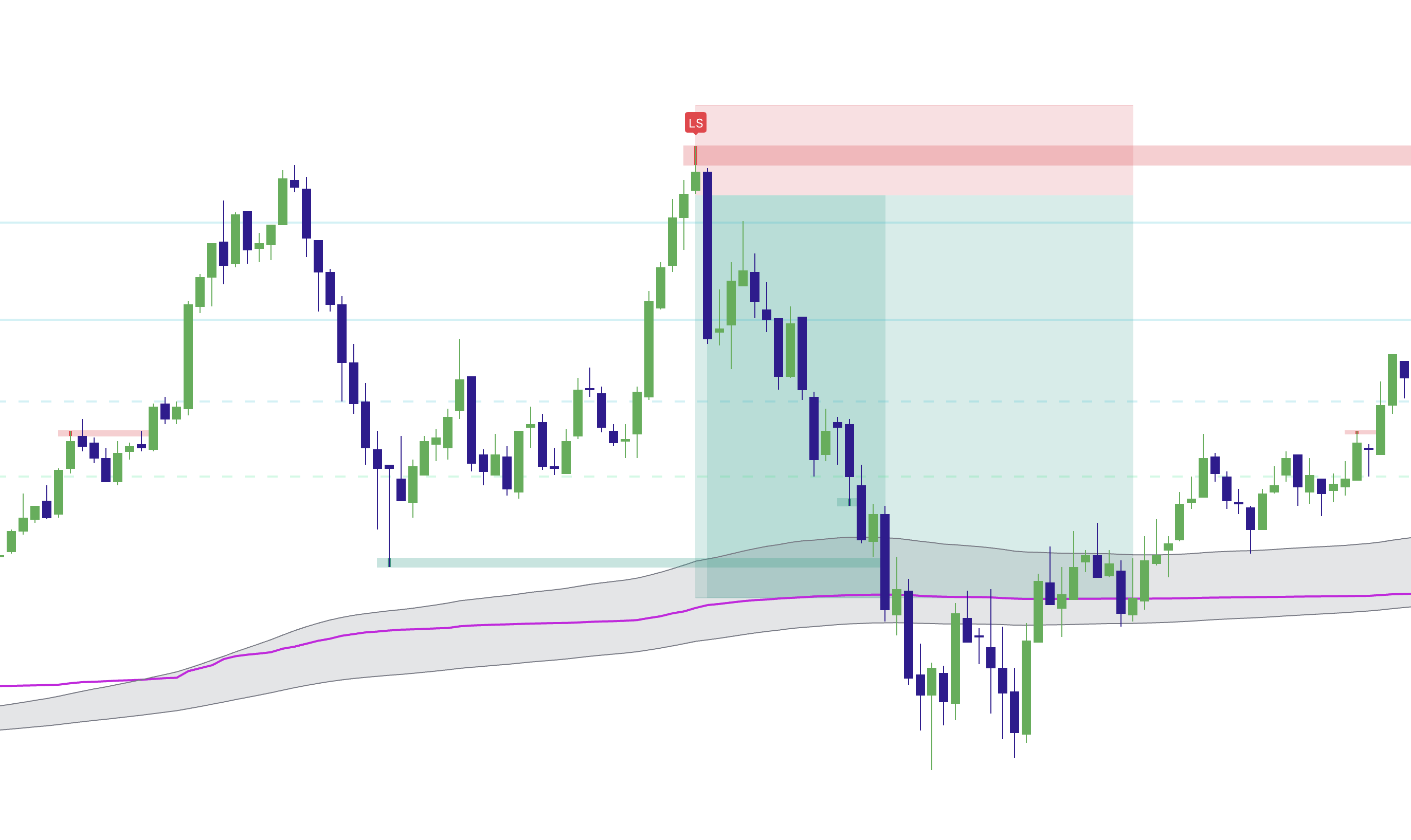

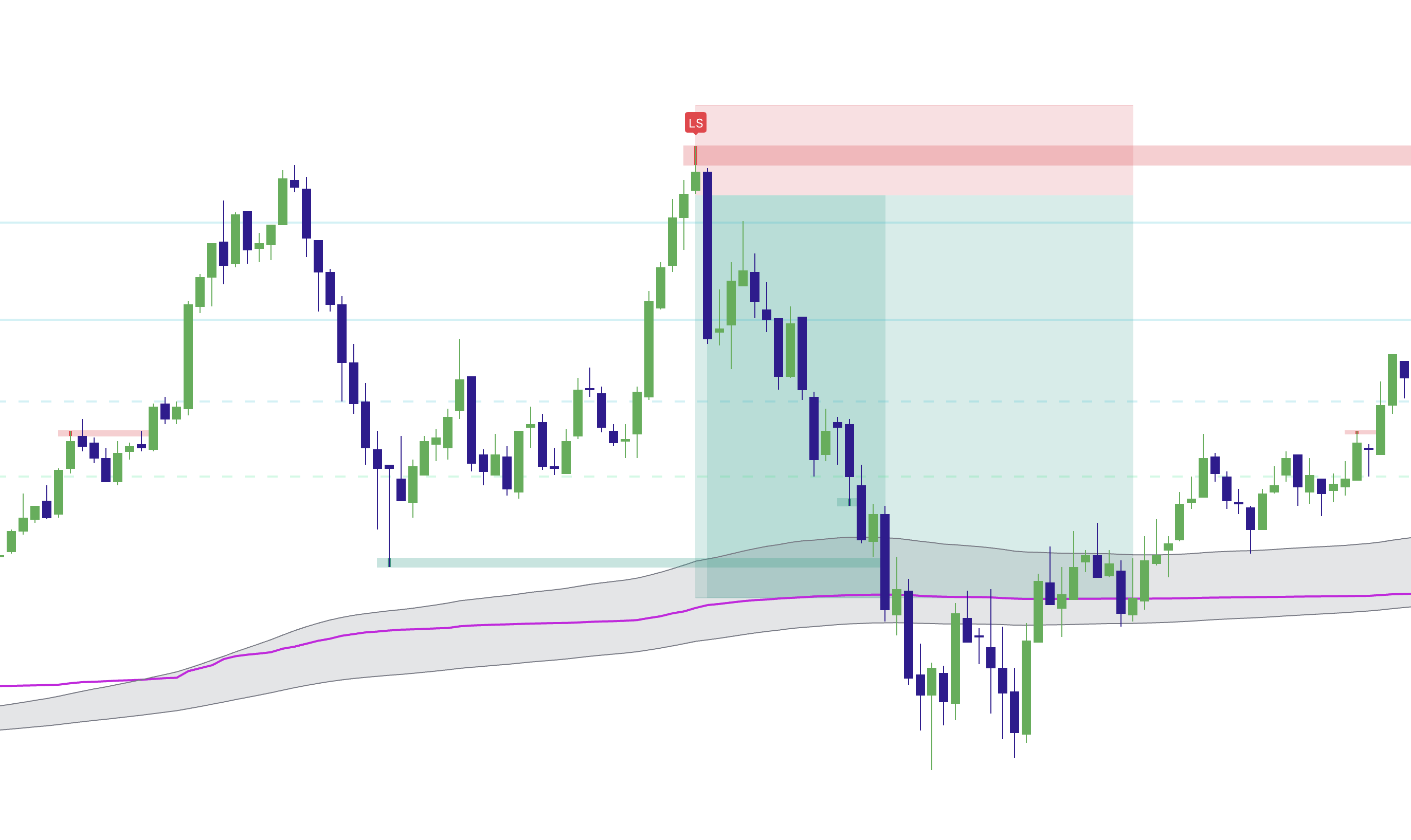

What Elev8+ Shows You During a Sweep

Elev8+ was built for NQ traders who want to trade after the stop hunt, not during it. A clean top-side sweep on your chart typically stacks multiple visual cues.

Optional suite lens: Market Map helps validate the sweep is occurring at a meaningful magnet, Market Extremes helps validate you’re near a regime boundary, and Momentum Gaps helps define clean rotation objectives once rejection confirms.

On a real sweep, you will often see some combination of:

- Price tags a sweep level – prior day high/low, session extremes, or a major pivot plotted by the system.

- Wick through the level – the candle closes back inside instead of holding above/below the line.

- Elev8+ reversal confirmation – a triangle or premium label prints at or just beyond the level, validating rejection.

Mindset shift

When the sweep confirms, your job is to stop thinking like a breakout trader and start thinking like a liquidity trader.

Core Playbook: Trading a Liquidity Sweep Reversal

This is a structured Elev8+ sweep framework you can test and adapt to your own rules.

1. Define your key levels

- Enable Sweep Levels+ or use Market Maps for the session magnets you plan to trade.

- Prioritize the few levels most likely to matter today (PDH/PDL and London High/Low are strongest).

- Hide what you are not trading so the chart stays readable.

- Market Map: Is this level also aligning with a previous day or session structure?

- Market Extremes: Is the sweep happening near a exhaustion boundary (higher-quality) versus mid-range chop (lower-quality)?

- Momentum Gaps: Where is the cleanest rotation objective (gap fill / inefficiency) on the way back to VWAP or mid-range?

2. Wait for price to run the level

- Price should trade into the level with intent—fast, emotional, and obvious.

- No trade yet. You are observing the liquidity harvest.

3. The Entry Trigger (If/Then)

- IF the candle pierces the level AND closes back inside...

- AND an Elev8+ signal (Triangle or LS) appears on a lower time frame 1m, 2m, or 5m.

- THEN you may enter on the open of the next candle.

4. Execute with a defined plan

- Stop Loss: Place strictly beyond the sweep wick. If price breaks that wick, the thesis is wrong.

- Target 1: Take partials at the mid-range or VWAP.

- Target 2: Hold runners for the opposing liquidity level.

The goal is not to capture the exact high tick. The goal is to participate once the sweep is validated and the risk/reward profile becomes inherently asymmetric.

Why Liquidity Sweeps + Elev8+ Can Create Positive Expectancy

Many struggling NQ traders repeat the same mistake: they buy breakout candles into liquidity or short directly into lows. Those orders become the fuel that more sophisticated participants use to build inventory.

The Elev8+ framework is designed to invert that positioning:

- You are not guessing where the market might stop—you are focusing on pre-marked liquidity zones.

- You avoid chasing emotional runs and instead require sweep + rejection + confirmation.

- You combine location, structure, and signals into a repeatable decision model.

Key takeaways

- Liquidity sweeps are a method of inventory transfer, not random spikes.

- Major levels amplify sweep quality and risk asymmetry.

- Wait for the candle close to avoid trading into a breakout.

- Confirmed rejection is the edge—patience is the cost.

How to Start Using This Today

- Add Elev8+ to your NQ chart and enable Sweep Levels+ and Reversal Signals.

- Define your session watch zones: PDH/PDL, Asia/London/NY extremes, and the clearest nearby structure.

- Optional: Add extra suite layers for clarity—Market Map (structure/levels), Market Extremes (boundary vs chop), or Momentum Gaps (rotation targets).

- Screenshot every sweep—winners and losers—and build a personal reference library.

- Start with smaller size while you refine timing, level selection, and execution rules.

Liquidity sweeps are not a hidden pattern—they are a recurring feature of how NQ trades. The difference is whether you get hunted by them or learn to trade the reaction after the stops are already cleared. Elev8+ is designed to keep you on the disciplined side of that equation.